32+ How much to borrow for home loan

The maximum amount you can borrow with an FHA-insured. About this mortgage calculation.

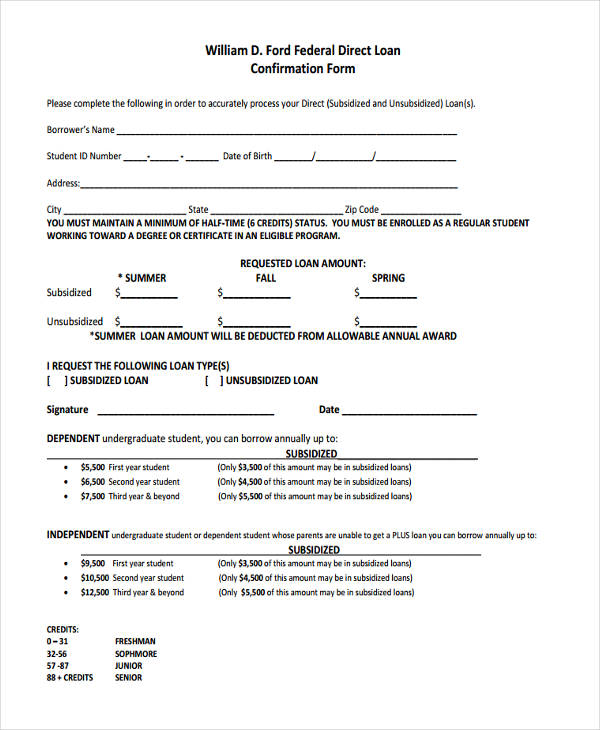

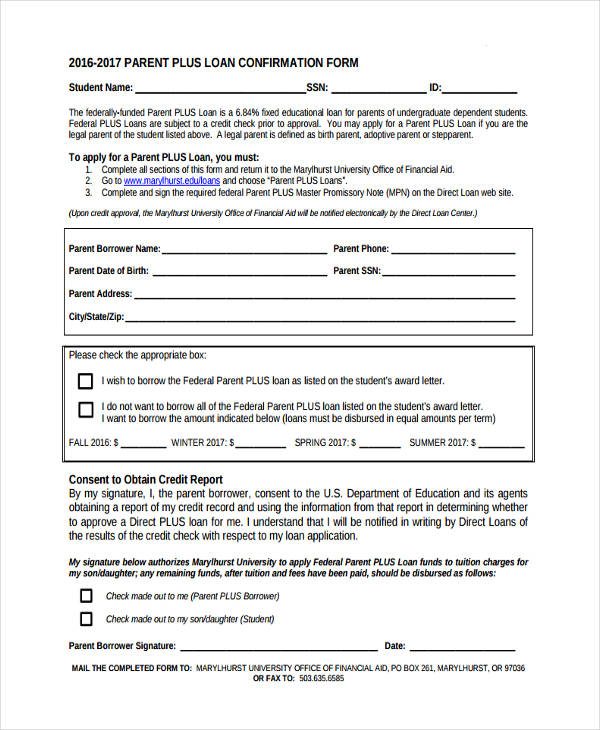

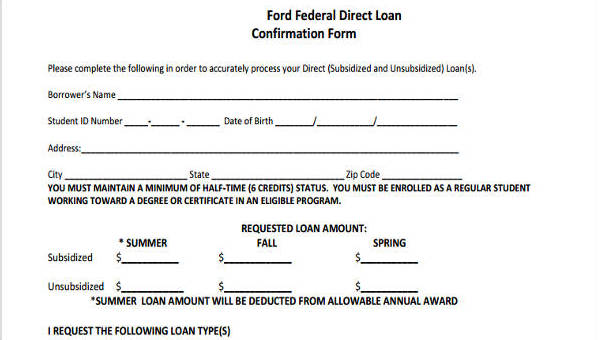

Free 8 Loan Confirmation Forms In Pdf

On a 30-year mortgage with a 4 fixed interest rate youll pay 14373938 in interest over the life of your loan.

. On a 20-year HELOC which has a current. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Home Loan Borrowing Calculator.

For this reason our calculator uses your. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details.

As part of an. The comparison tables below display some of the variable rate home loan. The duration of a loan is the time you.

How much of a loan can to take. 6 Number of Months. The calculator will appear below.

Find out how much you could borrow. Using Future Rental Income From Your Current. 23 hours agoThe current average 10-year HELOC rate is 617 but within the last 52 weeks its gone as low as 255 and as high as 620.

Total loan you can get would be 200000 and mortgage requirement would be 275000. Your total interest on a 200000 mortgage. How much can I borrow to buy a home.

Compare home loans on Canstars database. But ultimately its down to the individual lender to decide. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

Compare home buying options today. Our 4 step plan will help you get a home loan to buy or refinance a property. Speak to a home.

Solve using CalculatorSoup Loan Calculator. This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income.

Research how much you can borrow. How Loan Amount And Tenure Are Determined. Your mortgage loan eligibility also depends on your annual income.

As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75. You can borrow a minimum of 5 and a maximum of 20 of the propertys full price. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Heres a concise guide to getting a home loan in Singapore and figuring out how much you can borrow. If you have an understanding of how much you can repay ahead of time this ensures your expectations are realistic when you apply for. You have 220000 left to pay on your 30-year mortgage so you have 110000 worth of equity in your home.

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Find the Loan Amount Interest Rate. Lets say you own a home with a value of 330000.

6 Tips To Get A Perfect Home Loan Deal Axis Bank

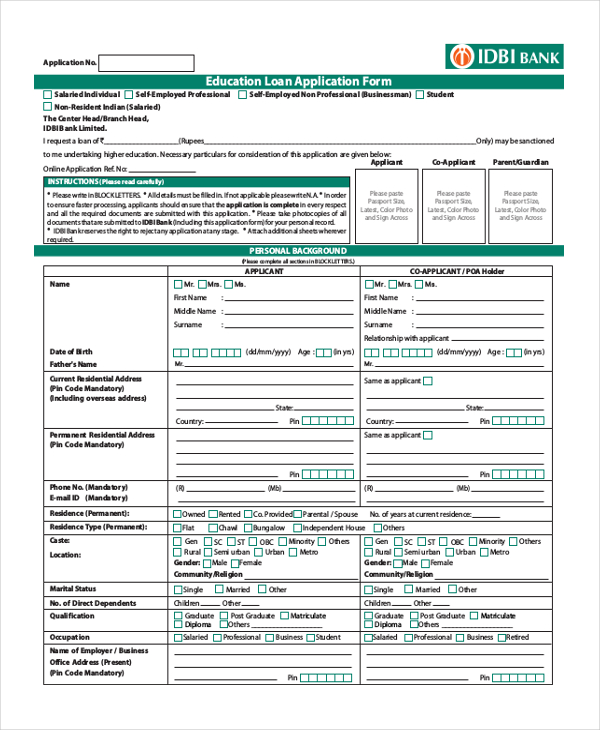

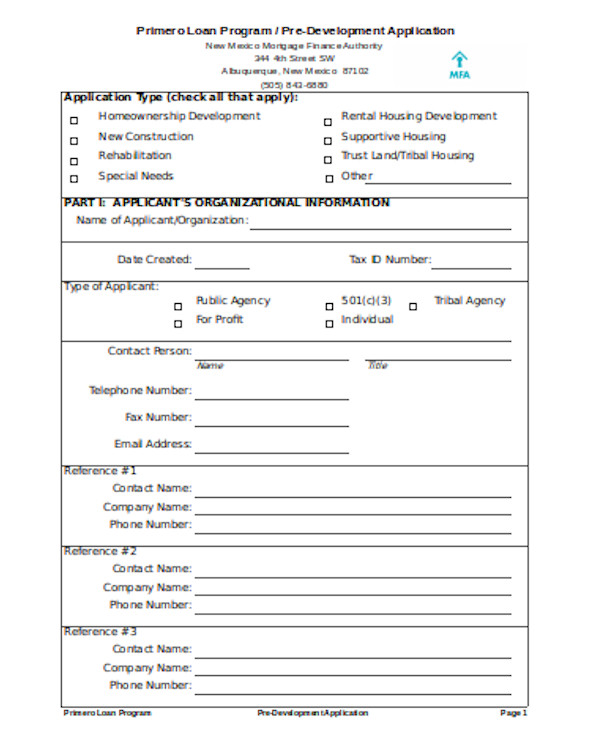

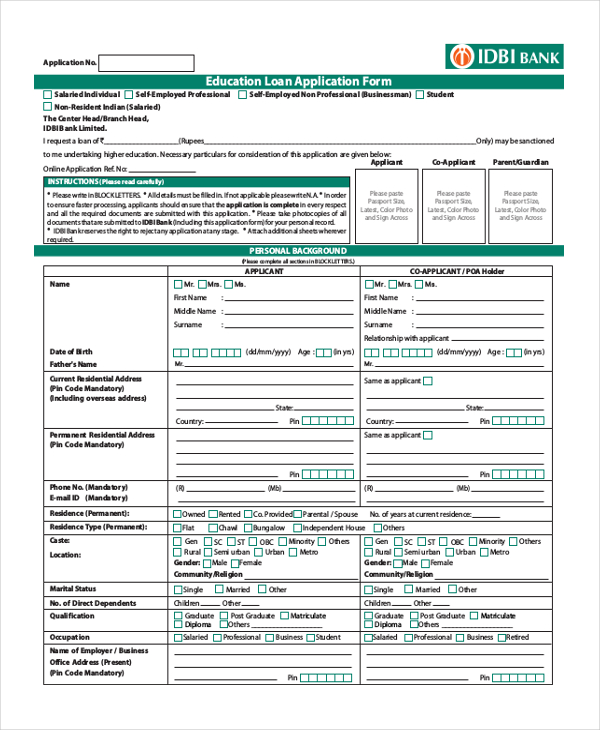

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Prospect Home Loans

Free 8 Loan Confirmation Forms In Pdf

Opting For A Home Loan From A Bank A Step Wise Guide By Nvt Quality Lifestyle Home Loans Loan Helpful

How Much Can I Borrow Online Mortgage Calculator Online Mortgage Mortgage Calculator Amortization Schedule

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Prospect Home Loans

9 Free Sample Loan Agreement Templates Printable Samples

Free 8 Loan Confirmation Forms In Pdf

Macquarie Home Loan Home Loans Home Outdoor Furniture Sets

Prospect Home Loans

9 Free Sample Loan Agreement Templates Printable Samples

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Cashapp Borrow 200 Loan Instant Approval How To Get A Loan From Cashapp Youtube Credit Card App The Borrowers Home Security Tips

Prospect Home Loans