27+ mortgage interest on taxes

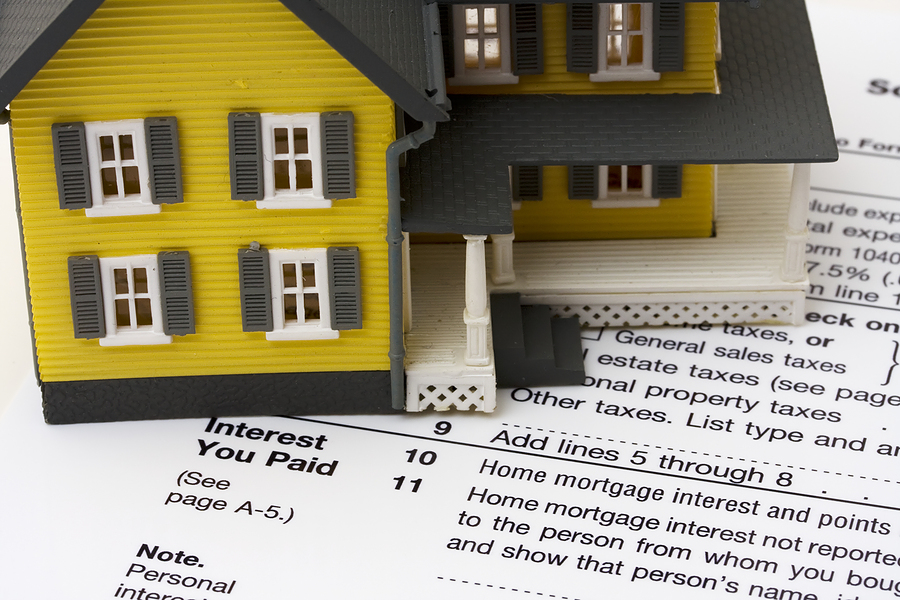

Web Basic income information including amounts of your income. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Downloadable Form W 9 Printable W9 Printable Pages In 2020 Inside Irs W 9 Printable Form Fillable Forms Calendar Template Blank Form

Ad Realize Your Dream of Having Your Own Home.

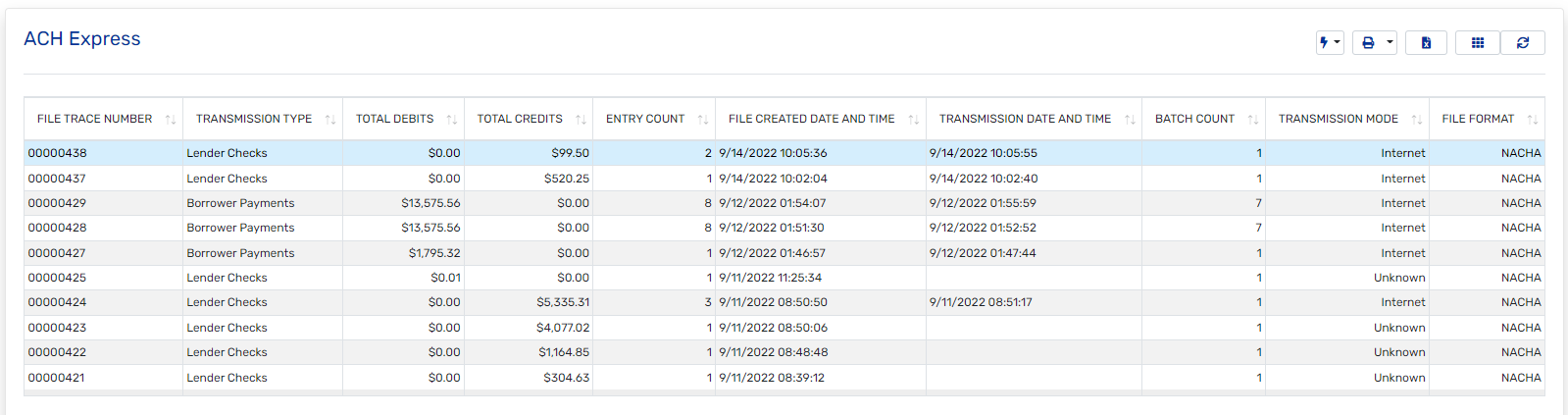

. Web March 4 2022 439 pm ET. Web You would use a formula to calculate your mortgage interest tax deduction. Web The average interest rate for a standard 30-year fixed mortgage is 702 which is an increase of 19 basis points from one week ago.

Also if your mortgage balance is 750000 or less or 1. Homeowners who are married but filing. Ad For Simple Returns Only.

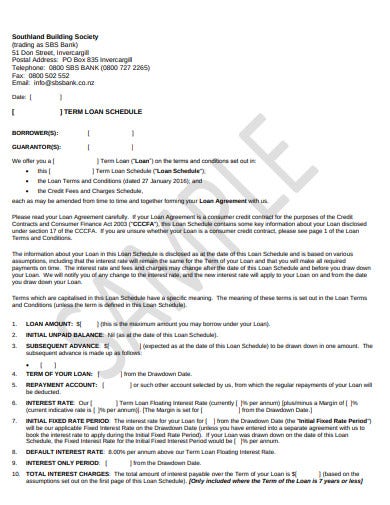

But for loans taken out from. Thats a maximum loan amount of. Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the.

Web 30-Year Fixed Mortgage Interest Rates. Web With this scenario you would be potentially paying an extra 168 a month in interest around 150 a month for mortgage insurance 375 a month in property taxes. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

Now the loan limit is 750000. Web Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web Mortgage interest. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to.

Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. For tax year 2022 those amounts are rising to.

Our Tax Experts Will Help You File Fed and State Returns - All Free. The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Fixed-rate mortgage of 707 on a 100000 loan will cost 670 per month in principal and interest taxes. 1987 your mortgage interest is fully tax deductible without limits.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Apply for Your Mortgage Now. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Take Advantage And Lock In A Great Rate. Web Answer a few questions to get started. 16 2017 then its tax-deductible on mortgages.

See If You Qualify To File 100 Free w Expert Help. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. View Ratings of the Best Mortgage Lenders.

Ad For Simple Returns Only. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. See If You Qualify To File 100 Free w Expert Help.

Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. Since you may be. Homeowners who bought houses before.

Use NerdWallet Reviews To Research Lenders. That means for the 2022 tax year married. He paid 19100 in mortgage interest in 2022 as shown on his 1098 form.

Our Tax Experts Will Help You File Fed and State Returns - All Free. Web A 15-year fixed-rate mortgage with todays interest rate of 631 will cost 861 per month in principal and interest on a 100000 mortgage not including taxes. Web What counts as mortgage interest.

Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage. Web Most homeowners can deduct all of their mortgage interest. Compare Rates of Interest Down Payment Needed in Seconds.

A basis point is equivalent to. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web Updated 01272023 Fact Checked.

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Free 9 Personal Financial Statement Samples Templates In Pdf Ms Word Excel

Loan Schedule 15 Examples Format Pdf Examples

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Home Mortgage Interest Deduction Lendingtree

Spring Texas Property Taxes Real Estate Taxes Discover Spring Texas

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Keep The Mortgage For The Home Mortgage Interest Deduction

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Progressive Tax Example And Graphs Of Progressive Tax

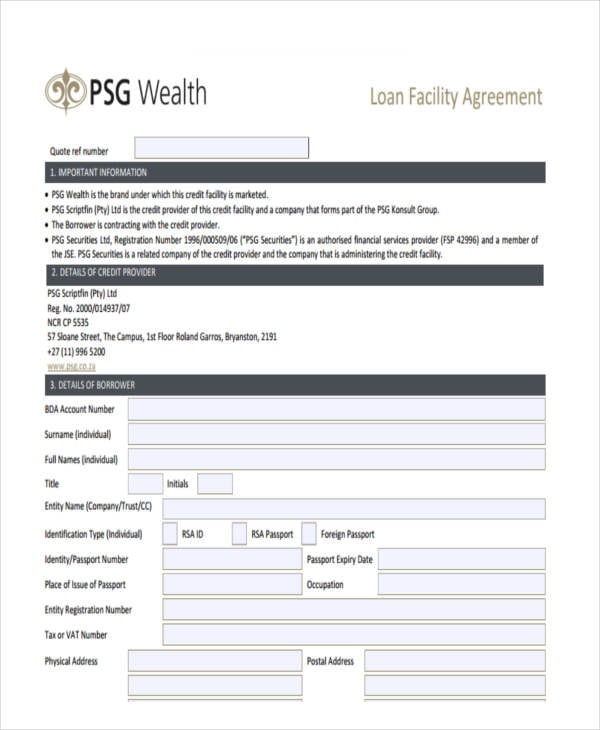

27 Loan Agreement Formats Word Pdf Pages

Business Succession Planning And Exit Strategies For The Closely Held

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction A 2022 Guide Credible